Retiree concerns reverse mortgage

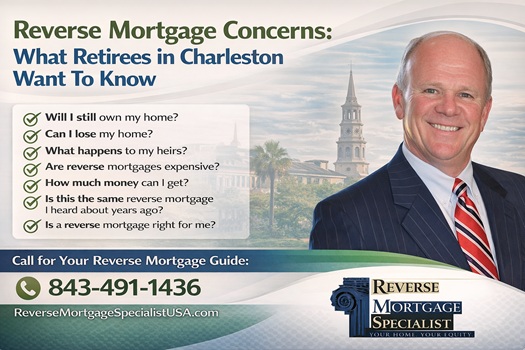

If you’re researching a reverse mortgage in Charleston, you probably have more questions than answers. That’s completely normal. Here are the most common retiree concerns reverse mortgage you need to know about.

At Reverse Mortgage Specialists, we talk to retirees every day who want clarity, not sales pressure. They want to understand how a reverse mortgage works, what the risks are, and whether it fits their retirement plans.

This anchor guide covers the top reverse mortgage concerns we hear from South Carolina homeowners. In future articles, we’ll dive deeper into each topic to help you make a confident, informed decision.

What Is a Reverse Mortgage?

A reverse mortgage—most commonly a Home Equity Conversion Mortgage (HECM)—allows homeowners age 62+ to convert part of their home equity into tax-free proceeds while continuing to live in their home, as long as loan obligations are met.

Unlike a traditional mortgage, there are no required monthly principal and interest payments. The loan is typically repaid when the homeowner sells the home, permanently moves out, or passes away.

But that simple explanation doesn’t answer the real concerns retirees have.

Top Retiree Concerns Reverse Mortgage

Let’s break them down.

1. “Will I Still Own My Home?”

This is the #1 question.

Yes — you remain the owner of your home. Your name stays on the title. A reverse mortgage is a loan secured by your property, similar to a traditional mortgage.

You must:

- Live in the home as your primary residence

- Maintain the property

- Pay property taxes and homeowners insurance

Failure to meet these obligations is one of the most common reverse mortgage concerns — and something we always explain clearly.

2. “Can I Lose My Home?”

This concern often comes from outdated myths.

You cannot lose your home simply because:

- Your home value declines

- You outlive the loan balance

- The loan balance grows over time

However, you could face issues if you fail to meet loan requirements (taxes, insurance, occupancy). That’s why education matters.

3. “What Happens to My Heirs?”

Many retirees in Charleston and throughout South Carolina want to leave their home to their children.

Here’s how it works:

- Heirs can repay the loan balance and keep the home

- They can sell the home and keep any remaining equity

- If the home is worth less than the loan balance, FHA insurance covers the difference (non-recourse protection)

Understanding how inheritance works is a major part of reviewing any reverse mortgage guide.

4. “Are Reverse Mortgages Expensive?”

Yes, they can be. There are costs — just like with any mortgage.

Costs may include:

- FHA mortgage insurance

- Origination fees

- Closing costs

- Servicing fees

The real question retirees should ask is:

Does the benefit outweigh the cost in my retirement plan?

For some homeowners, it eliminates monthly mortgage payments and improves cash flow. For others, it may not be the right fit.

5. “How Much Money Can I Get?”

The amount depends on:

- Your age

- Your home’s appraised value

- Current interest rates

- Existing mortgage balance

Generally, the older you are, the more you may qualify to access.

Funds can be received as:

- A lump sum

- A line of credit

- Monthly payments

- Or a combination

We’ll explore strategies retirees use to structure reverse mortgages for income planning and liquidity.

6. “Will This Affect My Social Security or Medicare?”

Reverse mortgage proceeds are considered loan advances — not income.

This means:

- Social Security is typically not affected

- Medicare is typically not affected

However, needs-based programs like Medicaid or SSI may be impacted if funds are not managed properly.

7. “Is This the Same Reverse Mortgage I Heard About Years Ago?”

Many retirees remember the horror stories from decades ago.

Today’s FHA-insured HECM loans include:

- Mandatory HUD counseling

- Non-recourse protections

- Financial assessment requirements

- Federally regulated lending standards

Modern reverse mortgages are structured very differently than earlier private products.

Education eliminates fear.

8. “Is a Reverse Mortgage Right for Me?”

This is the most important question.

A reverse mortgage may make sense if:

- You want to eliminate an existing mortgage payment

- You need supplemental retirement income

- You want a standby line of credit

- You plan to age in place

It may not be ideal if:

- You plan to move soon

- You want to preserve maximum home equity

- You are uncomfortable with loan balance growth

Every situation is unique.

Reverse Mortgage Charleston: Why Local Guidance Matters

Real estate markets vary. Property values in Charleston differ from other parts of South Carolina. Taxes and insurance costs vary as well.

Working with a local specialist ensures:

- Accurate home value analysis

- Proper explanation of South Carolina-specific considerations

- Personalized retirement planning discussion

At Reverse Mortgage Specialists, our focus is education first.

Your Next Step: Get the Reverse Mortgage Guide

If you’re researching retiree concerns reverse mortgage or exploring whether this strategy fits your retirement plan, start with clear information — not internet myths.

Our free Reverse Mortgage Guide explains:

- How reverse mortgages work

- Real pros and cons

- Cost breakdown examples

- Inheritance rules

- Qualification requirements

- Charleston-specific considerations

No pressure. No obligation. Just education.

Request your free Reverse Mortgage Guide today and make an informed decision about your retirement future. Call South Carolina Reverse Mortgage Services now.

South Carolina Reverse Mortgage Services

Charleston, SC 29401

843-491-1436

www.reversemortgagespecialistusa.com/charleston